Intro

Technology defines what business is going to be like in the future. Just a decade ago, this statement used to be a rabble-rousing component of any technology-related speech, article or release. But with the explosive growth of Artificial Intelligence (AI) and its subsets — Machine Learning (ML) and Deep Learning (DL) — we can now surely say that technology-driven future of business we’ve been talking about so much is actually here. Investment strategies have never been so doubtless, risks — so easy to asses and overcome, returns on investment — so high and foreseeable. No wonder multi-trillion worth fintech industry was one of first ones to adapt the AI tech stack into its operations and benefit from it setting up a trend for the rest of the world. Today, we’re diving into the benefits of Machine Learning for such a controversial part of fintech as trading with its rapidly changing trends, risky yet highly promising decisions, and eventual trade drama.

What Is Trading And How It Works?

Before getting to all the machine learning-related talks here, let’s refresh the essentials like the basic understanding of trading on the stock market. At its simplest, trading is buying and selling stuff. Naturally, traders want to profit off of any deal they sign for. It works right when both parties — a buyer and a seller — think they’re getting a good deal (that’s actually the key trait of quality and effective trading).

Who do you trade with? With other people on the market who are trying to generate income, just like you. Brokers act as mediators connecting people with each other for new deals, usually online. Both sellers and buyers constantly rely on brokers in trading. Inventory (also called current asset or a thing of value in trading, something that people buy and sell).

Inventory left and time left define how aggressive you can be with your deals (the less time and more inventory you have, the pushier you can be). Vice versa, if you have more time and a lot of inventory, you can be patient and wait for better prices.

The world of trading runs by basic economic laws, like if there’re more buyers than things available for sale, the demand gets higher and the prices start to grow. As a trader, you want to buy things you expect to grow in price. When you go short (sell) and the market increases in price, you lose the money you could potentially gain if selling a bit later. There’s always a winner and a loser in trading, and these roles interchange every here and there. It’s impossible to always be on the winning side, but your aim as of a trader is to be a winner more often thereby maintaining a profit and balancing your finance. To go long (buy) for a stock in trading is a serious decision that require thorough analysis and expertise to be made yet keep you safe from unnecessary splurge.

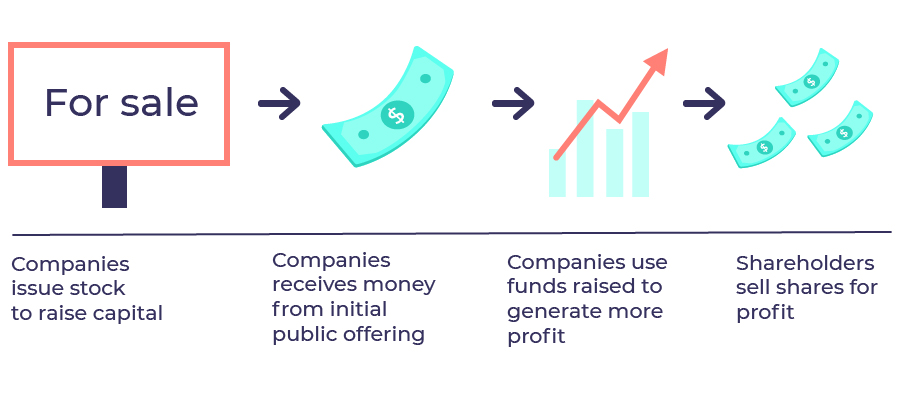

So why do businesses join the stock market in the first place? You probably won’t be surprised but the truth is, companies go public (enroll in the stock market) to generate incomes. Basically, they are offering small parts of themselves in the form of share to anyone who’d like to buy it. When you buy a share, it means you become a partial owner of a company. The more secure is the company’s position on the market, the higher is the share price. At the same time, new, not reputable yet, and unstable companies start at very low prices. As they grow, the share price is getting higher. A thing to always keep in mind is that the aim of all the stock market participants is to get better prices. Immediacy vs. price trade-off ratio is one of the factors traders and brokers look at to detect whether a potential deal would be a smart thing to do.

Although with their every single action traders strive for maximizing revenue while minimizing expenditure, there are different ways of trading and different ways of measuring success as well. Here are a few typical benchmarks used in trading:

- volume-weighted average price (VWAP)

- time-weighted average price (TWAP)

- Implementation shortfall (midpoint of bid-ask spread at the beginning).

Depending on the measures listed above, one can gather a comparative statistical data to use as a reference for future opportunities evaluation.

The deeper one dives into the stock trading, the more questions he starts to have here and there. For example, why would anyone sell a share in a prestigious company with a stable position on the market? The top two reasons why people decide to let their shares go are: a) a person just needs money right now and, as many beginners might not know, shares don’t have any value until you actually sell them. Share may worth a lot, but its value is locked until the shareholder exchanges it for real money. Even today, the trading industry is full of mysteries, and software engineers together with fintech analytics quickly recognized the amazing potential of machine learning applications for trading that could not only solve complex tasks for humans, but attract newcomers to the industry making it easier and more secure to trade.

What’s ML in The Context of Trading?

Since its invention, AI has been widely used in the fintech industry. Predictive models were the first AI application in finance, which brought its benefits to the AI adepts in finance. Afterwards, the financial industry started to invest in AI software, although it was at the time called overrated, risky, and uncertain. Artificial intelligence allowed banks to save budgets by decreasing the in-house human capital and partially allocating some of the functions to software like analytics and risk assessment. In its turn, this couldn’t help starting a trend of algorithmic everything in fintech, so naturally the hedge fund industry started moving towards the algo trading as well.

The only problem with that was the stock markets being the most dynamic and barely predictable area. This means, the trading algorithms have to be changed and adapted all the time. Needless to say, it was really hard for humans to follow in a timely manner. That’s when ML became a necessity — with it, algorithms can be changed automatically and their performance can be checked automatically as well.

Powers of AI in Trading:

- Market microstructure. ML can capture market activity in the moment of the trade so that it could evaluate the price in relation to the market state right when the decision to go short is made. This immediacy-to-price balance is the trait that defines a trader’s performance and distinguishes positive experiences from the negative ones, even in long term.

- Trading history analysis for future deals. The history of trading is another very important aspect when it comes to systematic approach to successful deals in the future. Regardless of what ready-made AI bots developed by trading companies tell you, algorithmic trading requires hours and hours of testing. And to test an ML model you have to actually start trading, so it’s better to start with small volumes first. Even if started small, a thoroughly tested ML trading model enables full historical order book recognition — one of the key things to riskless operations with stocks. Of course, you can test a new set of algorithms is to try them on simulated markets. This option seems to be less risky, but mind that a simulated market can be a lot different from the real one.

- Reinforcement learning. AI bot can learn how to read the financial price chart. Even though no one can know everything at once, it’s beyond doubt that the processing power of modern AI-powered software is higher than it is of a human brain.

- Optimized execution. Some traders find it tough to face the truth, but the facts say for themselves — artificial intelligence execute stock operations better than a human trader in the vast majority of cases. It cannot only build a precise linear regression model, but read what’s been built earlier and incorporate this data in the analysis. Unlike personal choices, ML-powered software makes decisions only basing on hard numerical data without any “what if…” doubts.

- Risk consideration. Fast analysis of big volumes of historical data allows us to assess risks and predict changes. Such censored observations enable smarter order routing, meaning AI can even buy orders and sell them to make a profit without human involvement and deliver less statistical errors (unprofitable deals) than a human would get.

- Stock prices prediction. Neural networks introduced to fintech with the progression of the deep learning (DL) tech stack allow forecasting assets’ prices. So far, this extremely complex activity can be accessed by those who are ready to invest in AI for trading due to the loads of computing power needed for any DL application, however the benefits it brings are shocking, and come with the high ROI to justify the splurge.

Deep Learning for Stock Market Operations

Unlike most programs use preset logic that engineers put in there, like a trading bot that makes only what you allow it to regardless of the context, DL-powered software thinks for itself — it analyzes the history of prices, checks the trading chart, and does lots of other things to get better deals. The key difference between a human trader and the AI one hides in numbers: while a person at average makes 5000 trades in 5 years, AI trader can make up to 1 million transactions in one night. This means, AI robots perform market manipulation — buy and sell orders in the fraction of a second, which is also known as high-frequency trading. Add to this the fact that with Deep Learning, trading programs gain experience from literally every move they make becoming smarter with each deal, and you’ll get why experts say AI is about to conquer the $3.5 trillion-worth hedge fund industry.

On the other hand, we all have to keep in mind that regardless of all the processing power, machines can only process data out of social context. Meaning, economics, politics, social factors, and emotions or intuition that change the industry from the outside, remain neglected in AI trading decisions. This might seem such a non threatening drawback when it comes to operation with numbers, but if you look at some of the past dramatic situations in world’s economy, you’d see that sometimes emotional quality can be more important than the intellectual one, and the first one out of the two cannot be simulated so far.

Summary

AI makes trades on your behalf in the most efficient manner — this is the main reason why traders started to use algorithms in the first place. As technology continues to drive world’s business, the sooner people will start to adapt to these changes, the better for their performance, especially in such fast-evolving industries as trading. At IDAP, Artificial Intelligence, Machine Learning, and Big Data aren’t just buzzwords — we know how to position emerging technologies in a way they bring great benefits without compromising business operations or costs. If you have been thinking about trying your hand in algorithmic trading with ML incorporated, reach out to start the project.

(3 votes, average: 3.67 out of 5)

(3 votes, average: 3.67 out of 5)