Intro

Finance industry is all about numbers and so is machine learning; no wonder these two got along so fast. Due to the numerical nature of both, finance was probably the first industry to benefit from machine learning applied to business issues. However, with the technologies becoming smarter, the machine learning applications for the financial industry advance as well. Processing capacity has never been so accessible, which makes getting important things done with no human interaction possible today. From assessing risks to preventing cyber attacks, machine learning today has plenty of applications in financial services. What are these application to be exact? Are they hard to develop and integrate into the performance routine of a financial institution? And is machine learning software even worth investing in 2019? This post is answering all the concerns surrounding machine learning in banking and finance as they’re now.

1. Fraud Detection

According to CyberSource Fraud Benchmark Report, the vast majority of North American businesses continue to perform manual transaction reviews for up to 29% of all company’s orders. Although the rest of the orders gets checked by software tools and systems, both third-party and internally developed, the accurate detection of fraud behavior patterns is still impossible if human workers aren’t involved. Manual review in its turn cannot be called a perfect solution either: it’s complicated, time-consuming, expensive, and not that effective. Manual transaction checks for frauds actually brings a lot of false negative findings. In theory, this challenge could be solved if a company would invest in extensive personnel training and provide extra budget and talent pool to establish a corresponding department. However, even if these steps are carefully followed and a company puts maximum effort to promote manual fraud detection, slower services and overwhelming attention to client actions will only trigger customer frustration and mess your brand image up.

While manual reviews produce many false negatives, fraud prevention software brings a lot of false positive results, which doesn’t add to company’s performance either. Over 90% of fraud detection software use transaction patterns to differentiate fraudulent activity from a behavior of authentic client. You might have heard of this as a rule-based approach to expose financial fraud in computational finance. In its essence, this approach is based on a digital platform following certain verification algorithms manually scripted by fraudulence analysts. Usually, any nonconforming transaction gets extra attention from the financial institution side. Today, verification software uses in average 300 rules to check a transaction, which seems to be a lot, yet still not enough to expose all correlations that would be typical for one client, but totally bizarre for another person. To cover up the semi-effective performance of such software, human workers are forced to interrupt them and adjust scenarios they follow, especially when it comes to double-check the positive fraud alert — frequently, it’s appears to be an authentic transaction from an unusual place or of a large volume. False positive fraud accusations are huge disadvantage of the rule-based approach towards suspicious financial activity, as they directly decrease client loyalty and affect buying decisions.

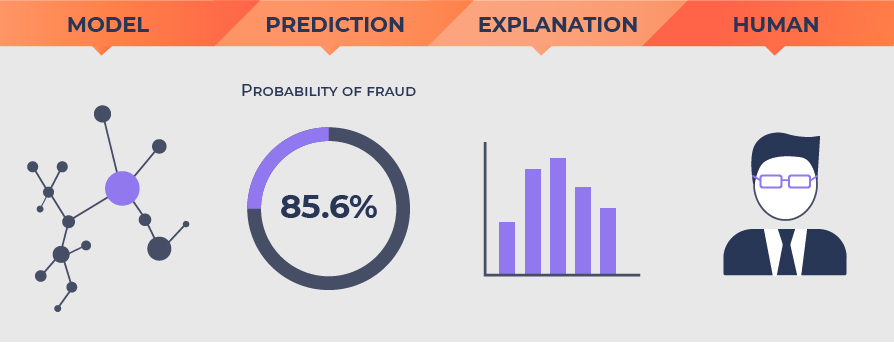

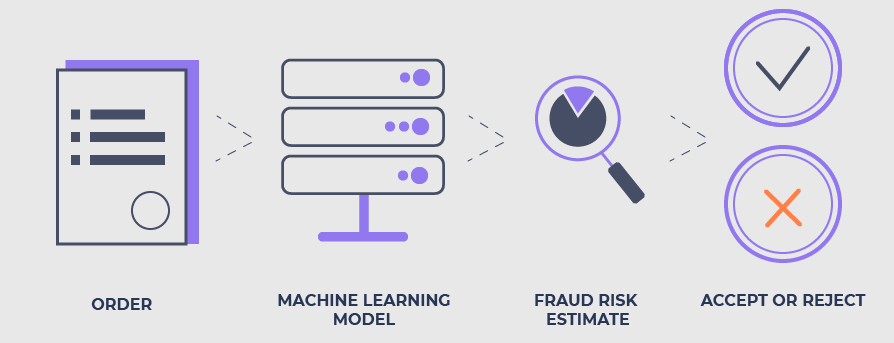

Machine learning (ML) is a science of positioning programs to act autonomously, without human involvement nor strict algorithms to follow. Software engineers position a machine to digest and process information in order to deliver correlations that a person simply could not assume, due to the limited human mind capacity and slowness of interconnections analysis amongst other reasons. The key power of machine learning lies in computers being able to improve their perception and processing of data over time by memorizing patterns and interpretations that took place in the past. That ability to learn from the past experiences turned ML into an ultimate solution for fraud prevention. ML-based fraud detection software is able to process huge data sets and provide accurate responses to the client’s behaviour, including personal approach to transaction verifications without total adherence to a single pattern. With machine learning against fraudulent activity, people get involved in the working process only after the software has gone through the train-test-predict cycle and the time to make a decision came. This optimizes operations and makes fraud prevention more effective, as well as smooth and seamless for clients.

2. Risk assessment

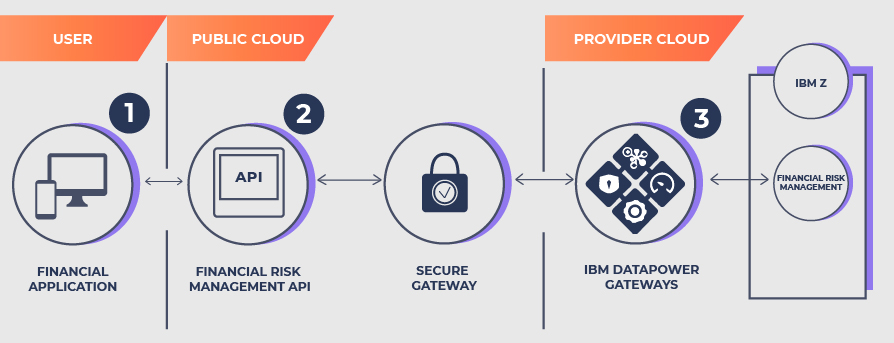

Machine learning in finance has revolutionized the way we approach financial risk management. With its ability to process large volumes of unstructured data and provide people with its quality analysis, we now have insights to deeper understanding and control of risks and everything connected with them. For example, a standard credit score calculation consists of a numerical characteristics, positive or negative ones, that serve as a basis for a decision about a person’s creditworthiness. When gathering these characteristics by financial tools currently in use, non-numerical data oftentimes gets ignored due to the fact the software simply cannot recognize and adequately process information that isn’t expressed in numbers. That’s why ML becomes a necessity — its innate ability to work with non-numerical and atypical data prevents banks from missing out personal client information of crucial importance, as well as saves employees from processing it manually and falling victim to their own prejudgement about potential customers they don’t know yet.

Software engineers recognized the potential of AI applications to address financial risks way back in the 1990s. Namely, in 1994 the first comparison of traditional bankruptcy prediсtion method and alternative solution with the use of neural networks took place. At the time, machine learning wasn’t agile enough to assess risks on its own, however, engineers concluded that if two approaches — statistical calculations and neural networks analyzing data — combined, the findings get to the whole new level of accuracy.

Unfortunately, with the progressive effectiveness, machine learning for financial risk assessment also brings a few challenges to the table. First of all, suitable data needed for the thorough and accurate analysis isn’t always available. ML engineers are working hard to solve that problem, for example Python and R packages already have no problem interpreting various kinds of data from SQL and Excel files to natural human language and pictures. But the time needed for quality analysis of information and cost to technically support that process remains unbearable even for industry leaders, especially when it comes to real-time data processing with ML suite applied. Also, even in 2019 it is no easy to find certified and experienced software engineers on the ML talent market.

3. Digital assistance

Digital assistance finishes up the list of top most popular ML applications in finance. In its turn, smart virtual assistants can be implemented in real life as two options — transactional bots and knowledge bots, also known as virtual assistant apps including Apple Siri, Google Assistant, Amazon Alexa, etc.

The difference between the two types of AI-powered assistants lies in the level of functionality and independence of performance. Knowledge bots have Automatic Speech Recognition (ASR) system as a core, they interpret user’s voice into commands to follow. Such applications support numerous processes at once and in some cases are able to make decisions for the user analyzing his/her behavior and habits. Machine learning combined with natural language processing allows knowledge bots go beyond a limited set of functions by literally understanding what you’re telling them regardless of the context. For example, for its Assistant Google uses a network of digital neurons which act similarly to human brain cells. Basically, this artificial neural network mimics the mental activity of our brains and simulate the processes starting when we hear the continuous stream of sounds. Regardless of the differences in architecture, all knowledge bots are powered by a neural network at the backend.

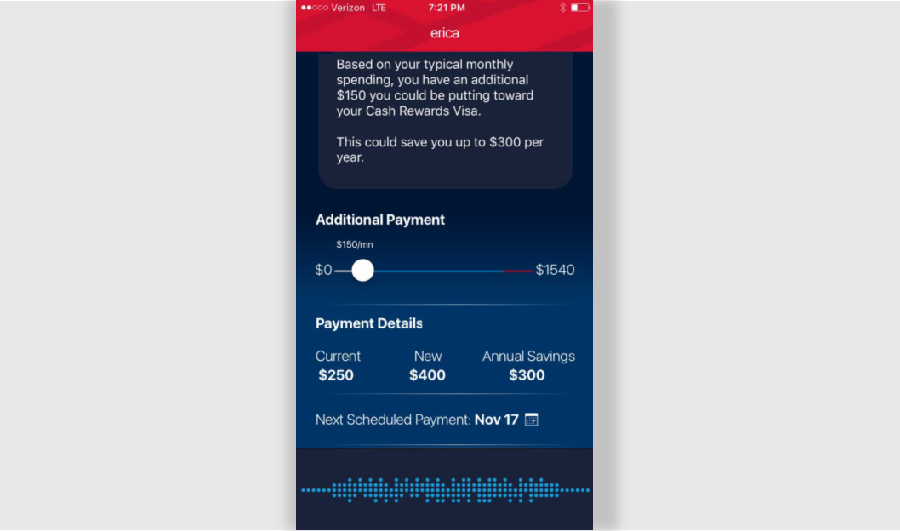

Transactional bots, on the contrary, are optimized to perform a limited number of actions. The limit on the transactional bot functionality is set intentionally: this way, it performs smoothly and polishes its skills to provide the most accurate reaction to client’s request. The primary aim of transactional bots in financial industry is to shorten the average time of financial operation by limiting human labor and eliminating the need to talk to a human manager amongst customers. Supervised machine learning is the power standing behind any transactional bot. Today, these are capable of verifying customer identity, block and unblock banking cards, confirm transfers, and answer frequently asked questions. Bank of America, a financial industry giant in North American region, has introduced its own transactional assistant called Erica in 2018. The bot started with sending notifications to clients, suggesting them ways to save money or even invest them, and helping with transactions. Erica was set to learn on its own by processing customer requests and memorizing successful scenarios of service distribution with an aim to expand bot’s capabilities in future. Although the company is satisfied with how the beta version of Erica has been doing so far, they also admitted it took major investments and the team of 100 people to make this project possible.

Summary

Once being an unrealistic hope, advances in machine learning for finance are triggering industry transformation today. Limited human labor, faster service, and unseen before personalization are just a few positive uses of machine learning we have to get used to. Whether it’s a transactional bot that helps clients to pay their bills in time or an enormous neural network that manages loads of data on its own, machine learning projects have walked their path from an uncertain future to a secure investment option of today. Ready to give it a try with your own ML-powered application? Drop us a line to quickly estimate the project.