About the Project

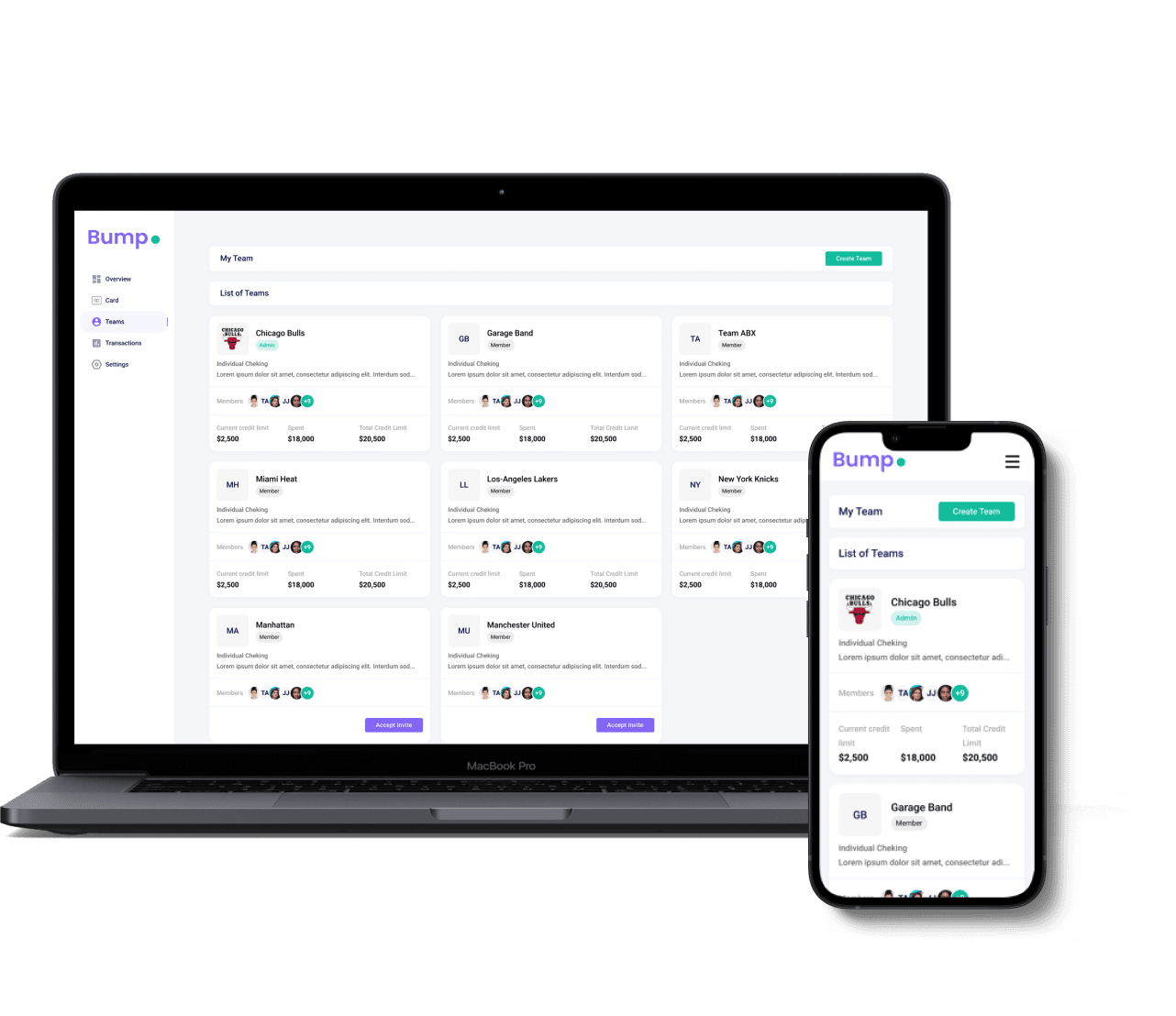

Bump is an innovative financial platform designed to help creators and freelancers make a living. By utilizing cutting-edge technology, the company seeks to disrupt traditional financing methods by providing needed resources, support and access to funds for those who need it most.

To develop Bump from scratch, the team first had to identify the needs of creators and establish a system that could meet these demands. This involved conducting extensive market research into existing platforms, understanding user behaviors, and mapping out key features that could be used as competitive advantages.

After identifying the functionality needed, they created detailed wireframes and prototypes backed by research data. The team has a few rounds of product testing with potential users to complete and refine their ideas before launching the MVP (Minimum Viable Product) version of Bump live in 2023.

Product Challenges:

Create a highly intuitive user journey that won’t require long hours of onboarding

The solution has to retrieve financial data from multiple sources

The app has to streamline financial management processes and make them easy and fast for creators

Key Features

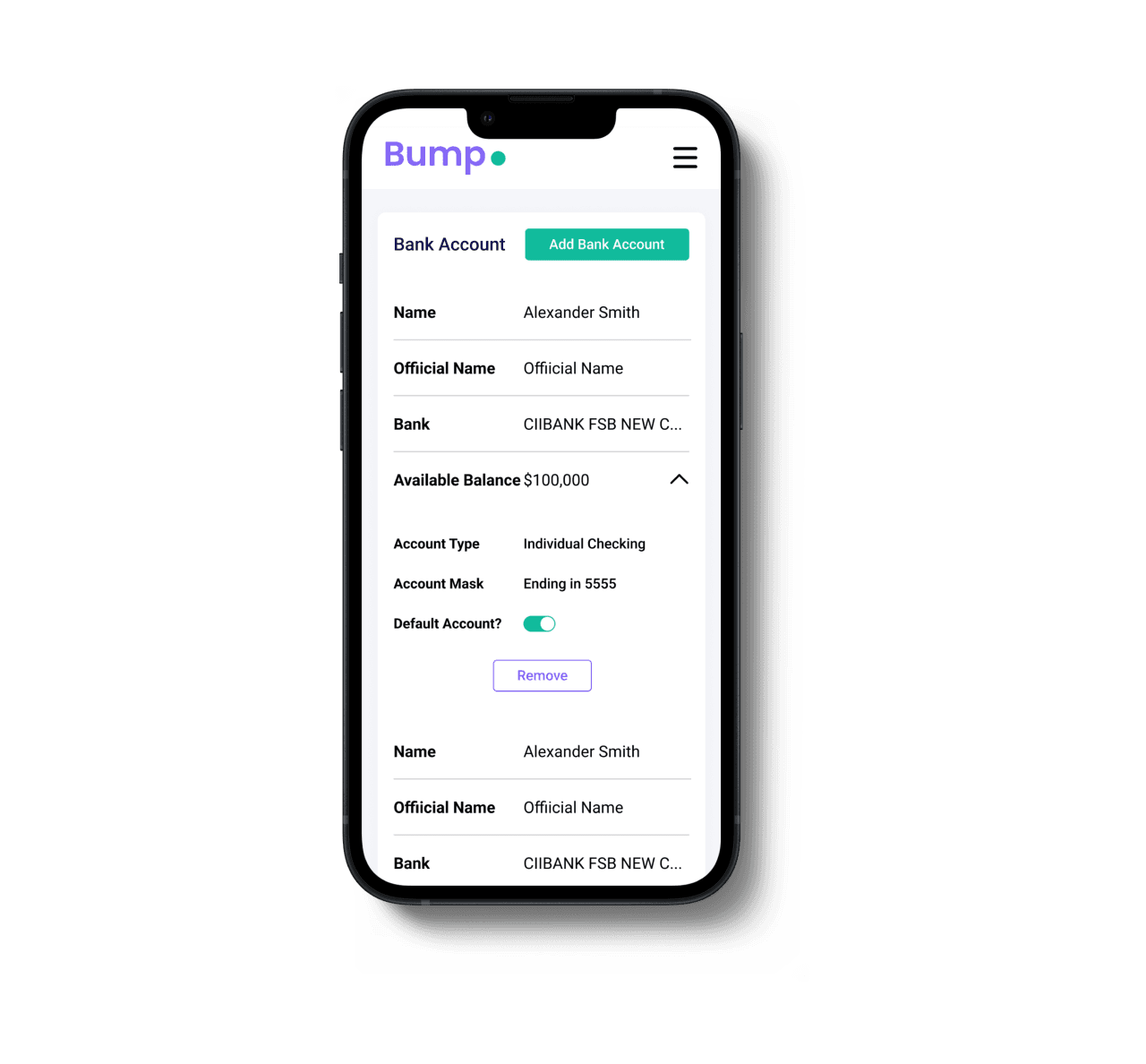

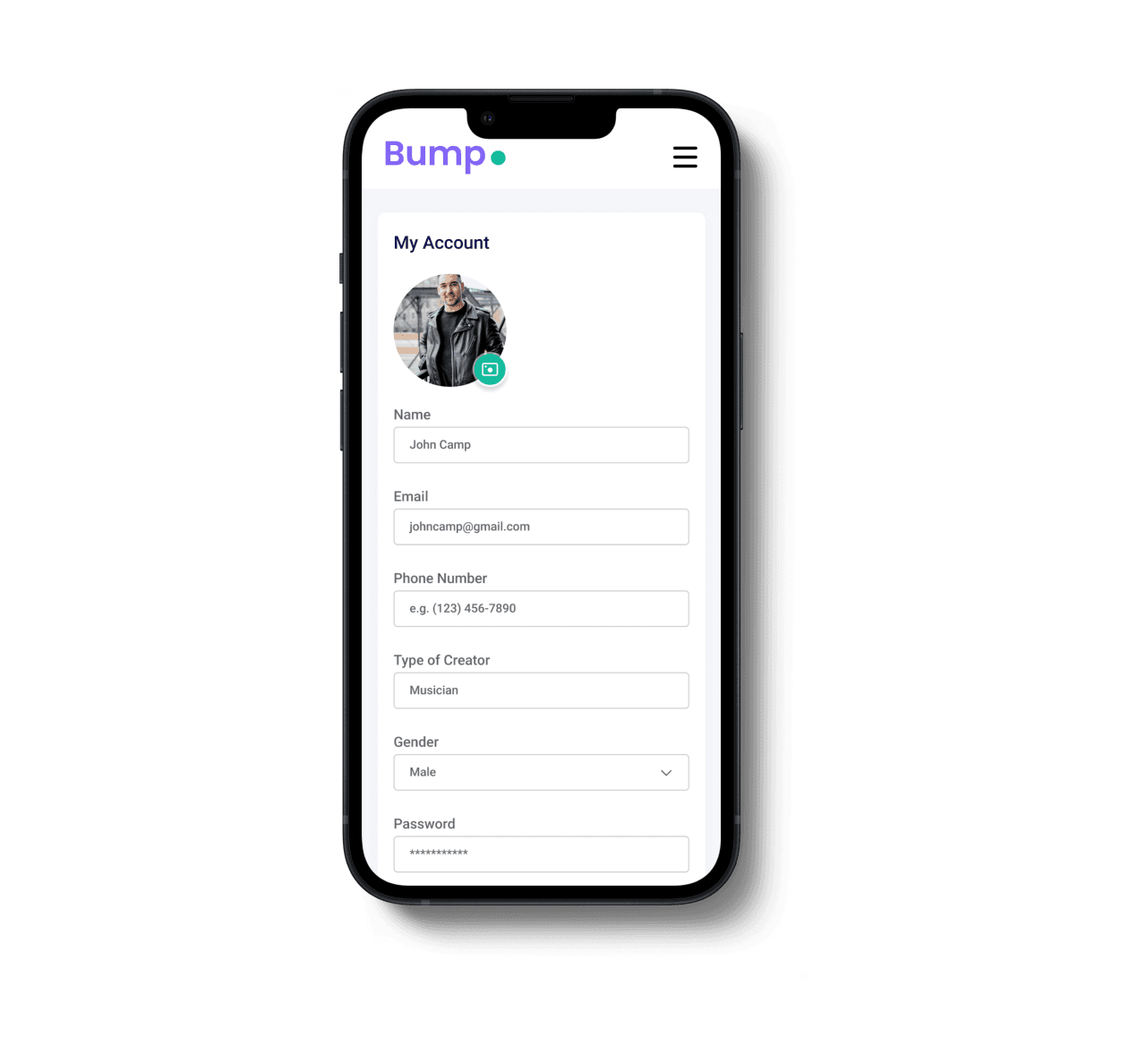

01Personal Account

Bump's personal account function allows users to securely store their banking information online while being able to access it from any device with an internet connection. This makes it easier for creators to transfer money between accounts, track inflows and outflows of cash, monitor spending habits, and stay on top of changing market conditions.

02Synchronization

Users can easily connect their current banking accounts to the platform for easy access to funds and streamlined financial management. Users can also monitor their spending habits in real-time so they know exactly where their money is going each month.

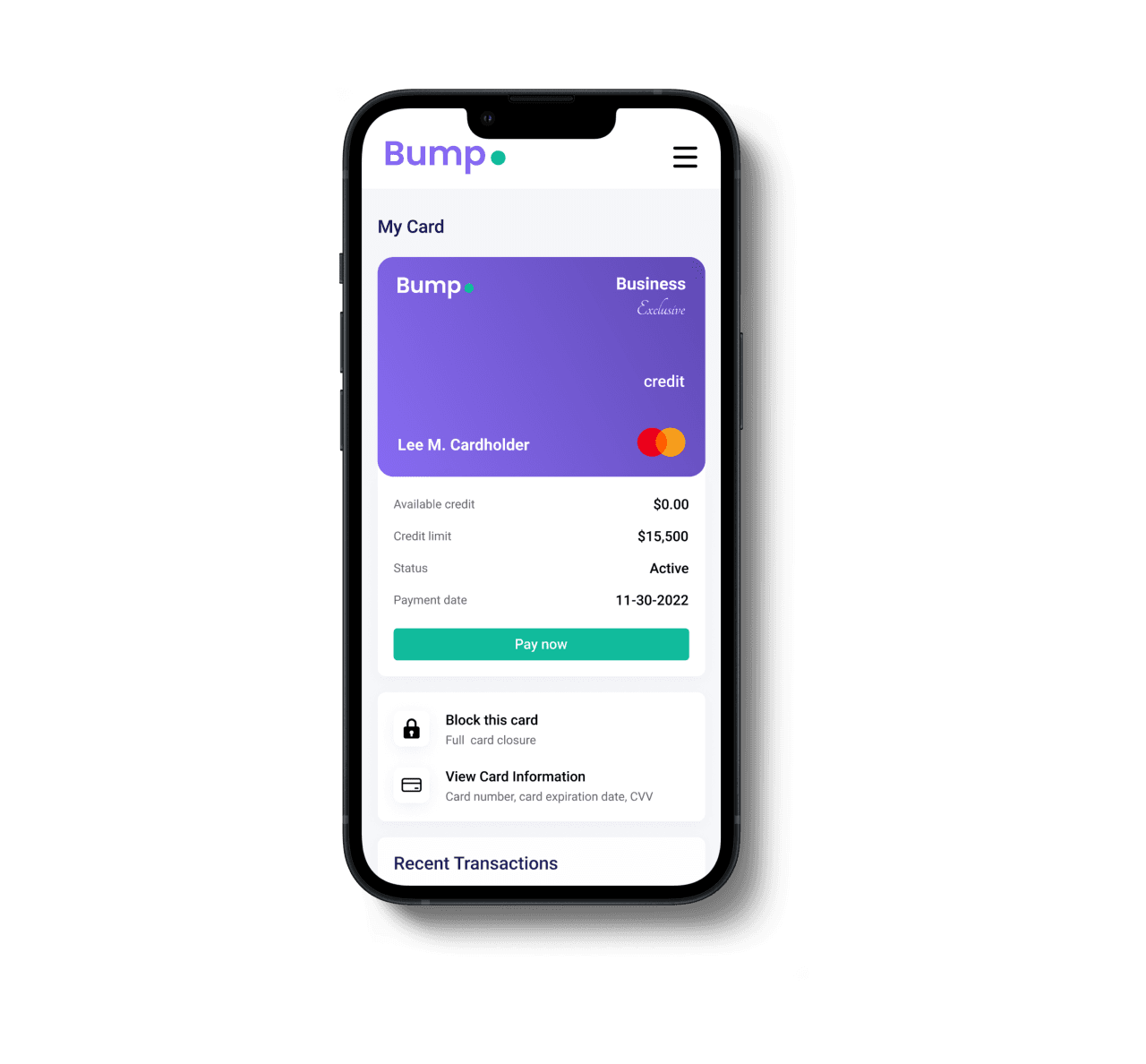

03Financial Management Dashboard

The dashboard allows users to quickly view all of their financial information in one place. From the dashboard, users can view details on upcoming payments due and past transactions made on the platform. They can also set up automatic payments for bills or recurring expenses, so they never miss a payment due date again!

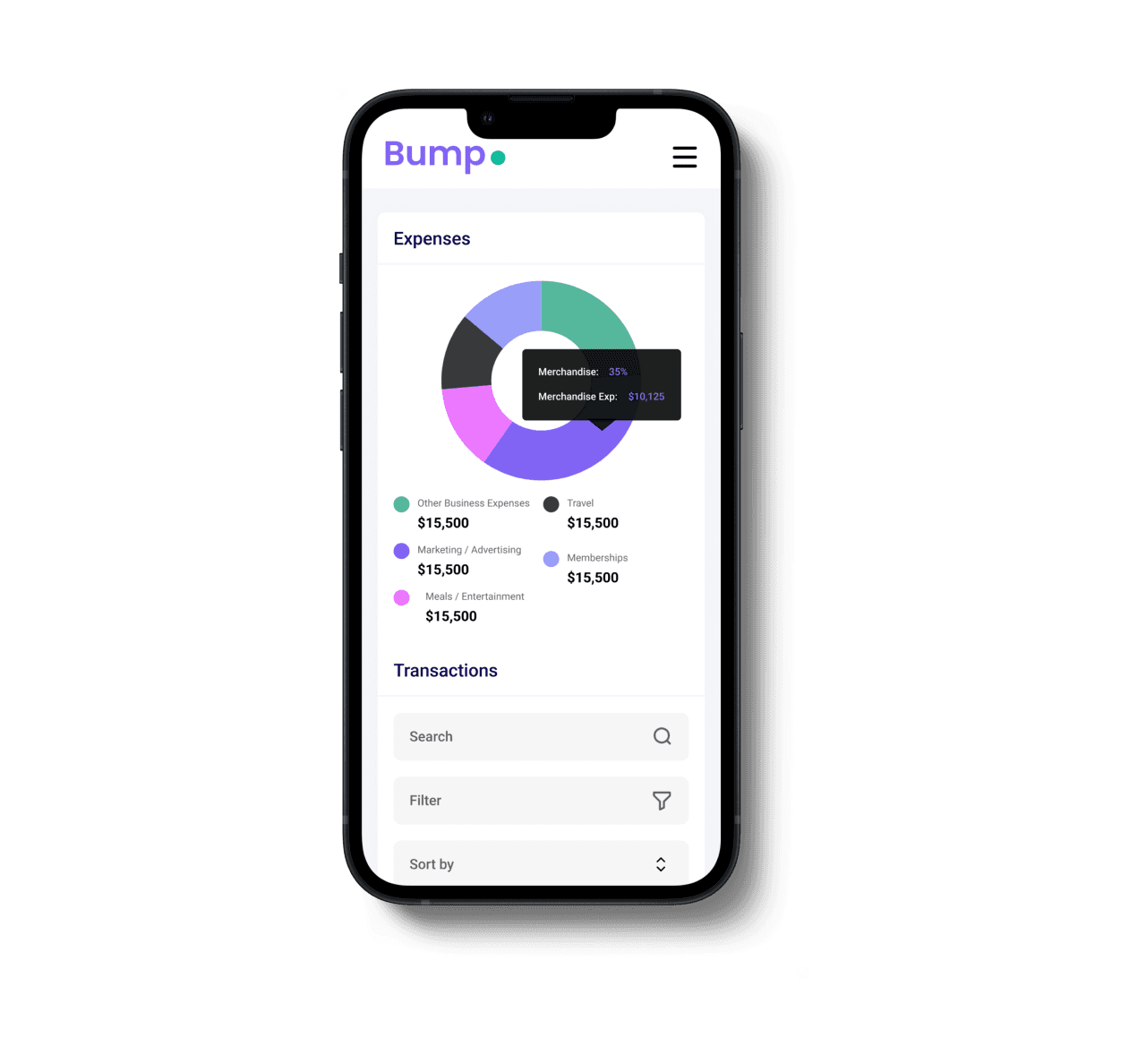

04Investment and Spending Tracking

Bump makes it easy to track both investments and spending over time so users know exactly how much they are earning or losing each month. They can see detailed reports on how much they have invested or saved throughout the year along with estimated returns on those investments. This helps them plan ahead for future financial goals while keeping track of current progress toward those goals at the same time.

05Notifications and Alerts

With notifications and alerts, Bump ensures that users never miss an important update or reminder related to their finances. Notifications range from reminders when bills are due to alerts when suspicious activity is detected in linked bank accounts, giving users total control over their finances with peace of mind as well!

Project Tech Stack

Frontend

Backend

DevOPS

More Projects

View AllNeed help with a product?

If you need support building your software solution from scratch or maintaining an existing one, please email us to discuss the details.

We use cookies. If you continue using our site, you confirm that you agree to our Privacy Policy.