The demand for technical innovation in a conservative bank environment has been hovering over the industry for some time now. However, now banks have to step out of their comfort zone and seize new opportunities brought forward by technology.

Only running a bank is not enough. It is crucial to transform it with banking app development to move forward sustainably. Banks have no choice but to find the balance between what they’ve used to and what tech has to offer. Read on to explore the reason.

Related: A Complete Guide to Modern Cloud App Development

Why banking app development matters for the financial sector

Increase Customer Convenience

Over 60% of people use mobile banking regularly, the majority being tech-savvy millennials. They like to solve their matters by themselves and do it quickly. Preferably online, without any unnecessary calls or waiting in line. Voice calls, too, are outdated, and so is visiting a banking branch office.

If you are still in doubt over the reasonability of developing a mobile banking application, you are missing out on a vast client pool.

Personalize Banking Services

Data. Data. Data. Today everything is about the information you have about what your clients are and what they want. A mobile application allows you to collect and analyze information your clients are putting into the application. What places do they visit? What stores do they go to? What fruit do they like? What time are they going home?

Banks have access to clients’ credit traces – a powerful source of information that can provide numerous insights. By studying the clients’ buying habits, your banking specialists can develop multiple strategies and initiatives to attract and retain clients. Moreover, it also could help to assist clients in tracking and working on improving their credit scores.

Lower Operational Costs

Moving the lion’s share of banking operations to mobile will kill two birds with one stone: increase efficiency and lower operating expenses. The mobile transaction costs two times lower than an on-site branch transaction.

By moving only 10% off regular on-site transactions of the regular on-site ones, you can save up the money used for paying salaries to office personnel, lease, and additional random expenses.

It’ll allow banks to optimize branches, close the ones with poor performance, reassign the tellers to other divisions, and improve overall business efficiency.

Expand As a Brand

Aside from offering customers an easy mobile banking application, banks can use the app to differentiate from their competitors. By studying clients’ needs and habits, you can develop a genuinely brilliant customer-oriented application with a sprinkle of the bank’s brand persona.

Work out extra features for mobile banking that clients cannot experience in the office branch, like checking whether the pending transaction has been successfully confirmed or adding a bonus account that would save up from your retail partners.

How to create a banking app: 3 hints to follow

Any mobile application development process should begin with careful preparation and planning. Understanding what you want to achieve, who to contact, and what functionality is essential for the end user is necessary. Here are the three most important things that should be covered before you start banking app development.

Know your customer

Understand who you are developing this mobile banking app for. Look through several pieces of research on how people use their mobile phones and what kind of apps they use, and check out the competitor’s apps.

At first, it may seem obvious that you are going to be dealing with tech-savvy millennials who cannot go a day without a phone. However, you are up for a surprise since nearly 45% of seniority worldwide use mobile banking. So you won’t know who to target before properly studying this topic.

Plan out the main functionality

After studying the people who are going to use your app, think about the necessary functionality it should have. It’s better to start small and fast than slow and complicated.

Listen to the clients. If everything they do is check their balance and transfer funds between cards, there is no need to do any extra. Start with several features and see how it works out.

Moreover, the more features the app has, the more it will cost.

Related: Custom App Development Cost

Find a market-proven software developer

There are several factors to mind when choosing an app development company for the upcoming project. Of course, you can always develop it in-house. But the cost of hiring and retaining your own technical specialists can become twice as much as developing and supporting an app.

General factors in mind when looking for a vendor:

- Location

- Rates

- Relevant expertise

- Solid portfolio

Related: About Software Outsourcing Market in 2023: Technologies, Pitfalls, and Solutions

Best-in-class fintech apps: success stories you should know about

The market is full of real-life success stories about cutting edge apps that became game-changers in banking and fintech areas. How about diving into the details of products, Portmone and Bump, delivered by the IDAP team?

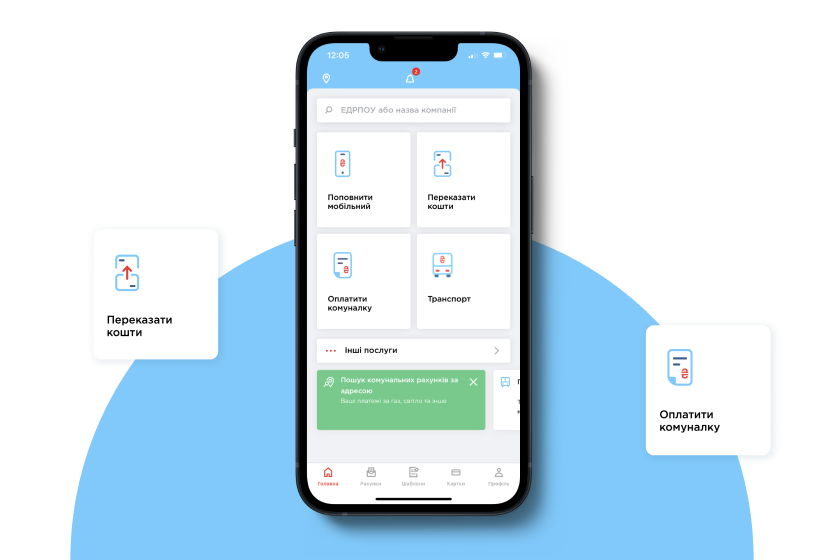

Portmone

Links: Google Play Store | App Store

Rating: 4.4 (Google Play Store); 4.8 (App Store)

Description: Portmone is a solution for convenient payments that covers almost all types of transactions in Ukraine and abroad, from utility payments to private money transfers.

Here’s how it works:

The first step is to create a Portmone account and connect it to the user’s bank account, debit or credit card, or e-wallet. Users can add their expenses to Portmone’s platform and set up automatic payments for recurring bills, such as utility fees or rent. The application provides users with a dashboard to monitor their spending and resources. They can track their payment history, see their account balances, and set up budget goals to manage their finances better. Therefore, Portmone’s payment optimization and resource tracking features make it a useful tool for anyone looking to manage their finances efficiently.

Read on to explore how we’ve created Portmone

Another bright example of the IDAP work is Bump all-in-one fintech platform for creators the team is currently working on.

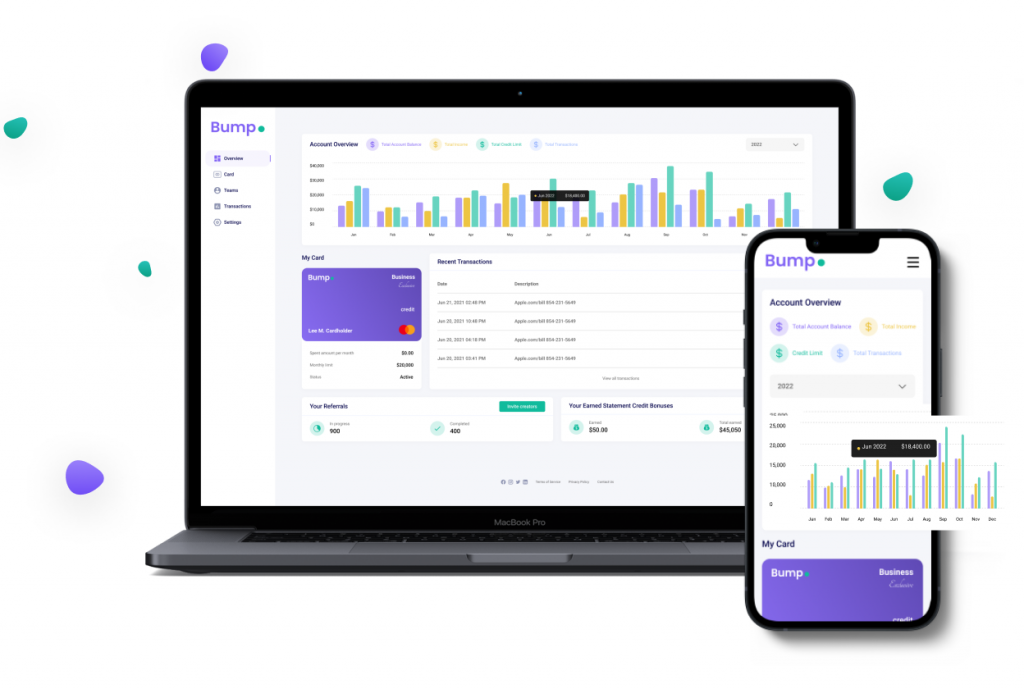

Bump

Description: Bump is an innovative financial platform that aims to help creators and freelancers make a living.

Here’s how it works:

Users have their personal accounts helping integrate with banking accounts, store sensitive data and access the app from any device effortlessly. With Bump dashboard, users can monitor their spending habits in real-time, view details on upcoming payments and payment history as well as set up automatic payments for bills or recurring expenses. To keep the payment process on track and ensure its security, the application sends relevant notifications and alerts.

Read on to explore how we are creating Bump

See more examples of software developed by IDAP:

Summary

Mobile applications have become essential to the banking culture as technology evolves. Banks that go in hand with the client demand for mobility can gain a competitive advantage with a user-friendly mobile app.

Looking for a way to design robust and long-live mobile banking app? Contact our sales team to explore how IDAP can speed up your Time-to-Market and ensure high ROI.